Chapter 2. Wright’s First Hay Companies

Wright Small managed a successful hay business in the early 1920s. He grew prairie hay and alfalfa, and with the help of his young brother Elmer, who was still in school, sold it to nearby farmers.

THE “HAY MAN”

In time, Wright and Elmer worked for a Kansas City broker, buying and shipping hay to Kansas City or other locations. Wright bought the hay and had it baled by a former Neodesha neighbor, John Clifton, Sr., who owned a stationary baler near a railroad station in nearby Buxton, Kansas. Elmer remembered loading the loose hay with a pitchfork. He and Wright took truckloads of sun-dried hay to Buxton, had it baled, loaded the bales into trucks and took them to the railroad station where they loaded the hay onto boxcars. Wright operated under two company names; W. J. Small, Shipper of Prairie Hay & Alfalfa, and W. J. Small, Dealer in Prairie Hay & Alfalfa. For business purposes, he thereafter went by the initials, “W. J.”

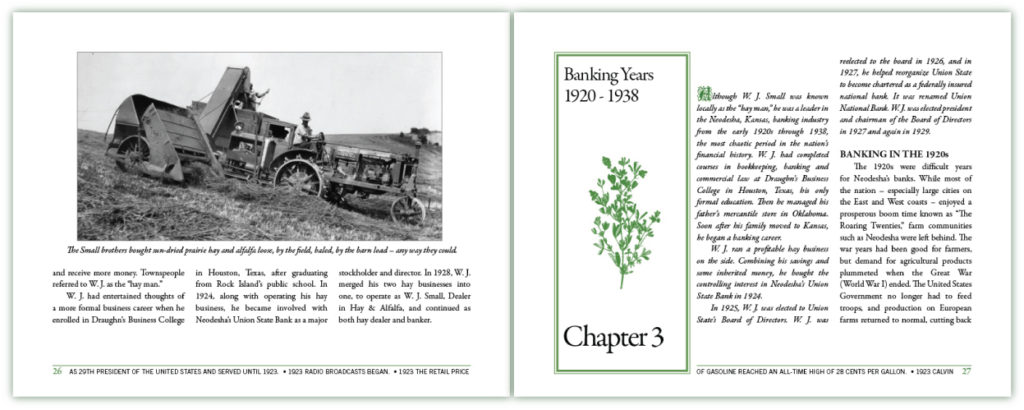

Knowing he wasn’t getting his fair share of the money, Wright quit working for the broker. He traveled to visit some of the broker’s customers, learned their needs and sold to them directly. He began selling locally, and as demand ran out in the immediate area, he shipped hay by railroad to a company in Missis-sippi that operated a chain of retail feed stores. W. J. and Elmer bought prairie hay and alfalfa loose, baled, by the field or by the barn load – any way they could – and shipped it direct. In season, they stored all the hay for which they could find storage and sold it in winter months when it was scarce and they could charge and receive more money. Townspeople referred to W. J. as the “hay man.”

W. J. had entertained thoughts of a more formal business career when he enrolled in Draughn’s Business College in Houston, Texas, after graduating from Rock Island’s public school. In 1924, along with operating his hay business, he became involved with Neodesha’s Union State Bank as a major stockholder and director. In 1928, W. J. merged his two hay businesses into one, to operate as W. J. Small, Dealer in Hay & Alfalfa, and continued as both hay dealer and banker.

Chapter 3. Banking Years 1920–1938

Although W. J. Small was known locally as the “hay man,” he was a leader in the Neodesha, Kansas, banking industry from the early 1920s through 1938, the most chaotic period in the nation’s financial history. W. J. had completed courses in bookkeeping, banking and commercial law at Draughn’s Business College in Houston, Texas, his only formal education. Then he managed his father’s mercantile store in Oklahoma. Soon after his family moved to Kansas, he began a banking career.

W. J. ran a profitable hay business on the side. Combining his savings and some inherited money, he bought the controlling interest in Neodesha’s Union State Bank in 1924.

In 1925, W. J. was elected to Union State’s Board of Directors. W. J. was reelected to the board in 1926, and in 1927, he helped reorganize Union State to become chartered as a federally insured national bank. It was renamed Union National Bank. W. J. was elected president and chairman of the Board of Directors in 1927 and again in 1929.

BANKING IN THE 1920s

The 1920s were difficult years for Neodesha’s banks. While most of the nation – especially large cities on the East and West coasts – enjoyed a prosperous boom time known as “The Roaring Twenties,” farm communities such as Neodesha were left behind. The war years had been good for farmers, but demand for agricultural products plummeted when the Great War (World War I) ended. The United States Government no longer had to feed troops, and production on European farms returned to normal, cutting back their need for American farm products. Overall, American farmers’ share of the national income shrank by nearly half, driving many thousands to bankruptcy. Farmers from the Great Plains to the Mississippi Valley were additionally bur-dened with decreasing yield per acre from overgrazing, flooding and drought. As farm prices and land values continued to go down, Neodesha’s banks suffered.

In April of 1929, the major stock-holder of Union National Bank, W. J. Small, bought the holdings of First National Bank’s major stockholder, Harry H. Woodring. This created a merger of the two banks, with W. J. holding majority stock. After purchasing Woodring’s stock in First National, W. J. also purchased the remainder stock and assets of Union National Bank, creating one bank, First National Bank.

The bottom began falling out of the rest of the nation’s economy in the late 1920s. In 1929, First National was forced to issue its own National Bank Notes. By terms of the National Banking Act of 1863, the government granted charters to banks, allowing them to issue notes valued at up to 90% of the par value of United States Government bonds that the banks had previously deposited with the government as security for the notes. The First National notes were ten-dollar and twenty-dollar National Bank Notes signed by W. J. as president of First National Bank of Neodesha. These notes look like today’s paper currency. They are now obsolete, but so many were issued that they still turn up in circulation and are accepted, if only by mistake, as today’s money.

BANKING IN THE 1930s

On November 29, 1929, the stock market collapsed, marking the beginning of the nation’s most severe and prolonged depression in history, the Great Depression of the 1930s. The downturn spiraled through commercial and industrial sectors of the economy. Consumers curtailed discretionary spending, and retailers, burdened with high inventories, slashed prices and cut factory orders. Factories consequently cut production, diminishing payrolls and purchases of raw materials, and capital goods, wages and prices fell, each undermining the other.

Money borrowed for homes or businesses could not easily be repaid when prices and wages fell, and the problems of debtors became problems for bankers. Borrowers could not make payments, and foreclosure was not an attractive option for banks at a time when collateral values were severely depressed. Banks were further pressured when depositors withdrew funds, and the returns from their stock-and-bond-laden portfolios eroded. Banks across the nation went under. Neodesha’s First National Bank held on through the beginning years of the Great Depression, although not without problems.

On November 8, 1932, Franklin Delano Roosevelt was elected President of the United States. During the four months until his inauguration the fol-lowing March, the depression grew worse by the day. Across the land, factories lay idle and farmers burned crops they could not sell. As much as a third of the nation’s work force was unemployed.

Uneasy about the country’s econ-omic future, bank depositors stood in long lines, waiting to withdraw their savings. Many institutions did not have enough cash on hand to meet the massive demand for withdrawals. Thousands of banks failed, taking the savings of small depositors with them. Other banks shut temporarily to avoid financial collapse. In some cities, “scrip” was used as a substitution for money.

Scrip was issued in Neodesha in 1933 by the Chamber of Commerce in denominations of five, ten, twenty-five and fifty cents, and one and five dollars. A list of businesses, pre-approved to receive scrip in return for written checks or warrants, was published in the local newspaper. Individuals or businesses not pre-approved by the Chamber of Commerce had to apply and return later, if approved, to receive their scrip. The newspaper warned against “the promiscuous acceptance of checks with the idea that they may at once be converted into scrip, as the committee might refuse to approve them.” In March of 1933, Roosevelt addressed the nation in the first of his “fireside chats.” Beginning with “My friends,” the president explained the government’s newest moves, assuring people it was safe to return their money to the banks that would open the next day. “You must have faith; you must not be stampeded by rumors…” And people did, in fact, deposit their money, returning $600 million in hoarded currency by the end of the week, and nearly $1 billion by the end of the month. Neodesha’s newspaper announced that as soon as the national government settled the present financial difficulties and money began to flow through regular trade channels, the local scrip would be called for redemption by the Chamber of Commerce.

RETIRING FROM BANKING

W. J. Small served as president of First National Bank and owned the majority of its stock for nine years. He finalized decisions for the bank, while at the same time, became more and more involved with a new agriculture business – the dehydration of farm crops. His specialty would become alfalfa, a crop he had first farmed after moving to Neodesha. In 1938, W. J. retired from banking to devote his full time to the dehydrating business.